NECO Financial Accounting Answers Released – See Objective and Theory Practice Questions Here.

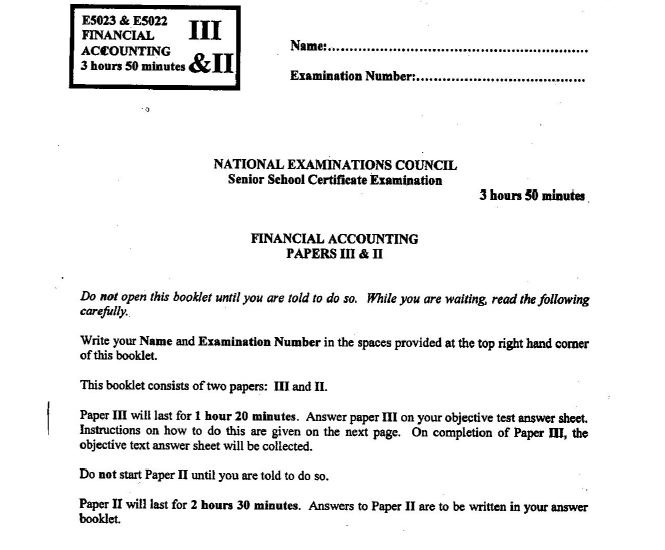

The Neco financial accounting 2023 answers have been released. The National Examination Council, NECO, Senior School Certificate Examination, Financial Accounting paper will be written on Thursday 10th August 2023.

The 2021 NECO GCE Financial accounting exam will comprise Papers III & II: Objective & Theory / Practice which will commence from 2.00 pm to 5.50 pm. This means the examination will last for three hours (3hrs) only.

Below, we will be posting out neco financial accounting questions for candidates that will participate in the examination for practice purposes.

NECO Financial Accounting Theory Questions 2023.

1. Explain the following:

(i) imprest system;

(ii) petty cash book;

(iii) memorandum entries;

(iv) three-column cash book;

(v) journal proper.

2. Describe three features of each of the following financial statements:

(a) Receipts and Payment Account;

(b) Income and Expenditure Account;

(c) Trading Account;

(d) Profit and Loss Account;

(e) Appropriation Account of a Partnership.

3. (a) Define and list two classifications of each of the following:

(i) asset;

(ii) liabilities.

(b) State and explain the factors to be considered in determining the annual depreciation charge for a fixed asset.

4. Classify revenue and expenditure into;

(a) capital expenditure;

(b) revenue expenditure;

(c) capital receipts;

(d) revenue receipts.

5. (a) Explain three reasons why an accountant will consider end-of-year adjustments.

(b) Explain how the following items are treated in the Profit and Loss Account and Balance Sheet:

(i) Provision for doubtful debts;

(ii) Depreciation on fixed assets;

(iii) Accrued income;

(iv) Prepaid expenses.

6. In the context of the Company account, explain the following:

(i) Promoter;

(ii) Prospectus;

(iii) Underwriting;

(iv) Bonus issue;

(v) Dividend.

Neco Financial Accounting Practice Answers.

7. In this question, candidates were required to prepare:

(i) Trading, Profit, and Loss Account;

(ii) Profit and Loss Appropriation Account.

8. Prepare a statement showing the effect of the errors on the draft net profit and the corrected net profit.

9. In this question, candidates were required to:

(i) prepare a Balance Sheet.

(ii) calculate the following:

(iii) acid test ratio;

(iv) capital employed;

(v) working capital;

(vi) current ratio.

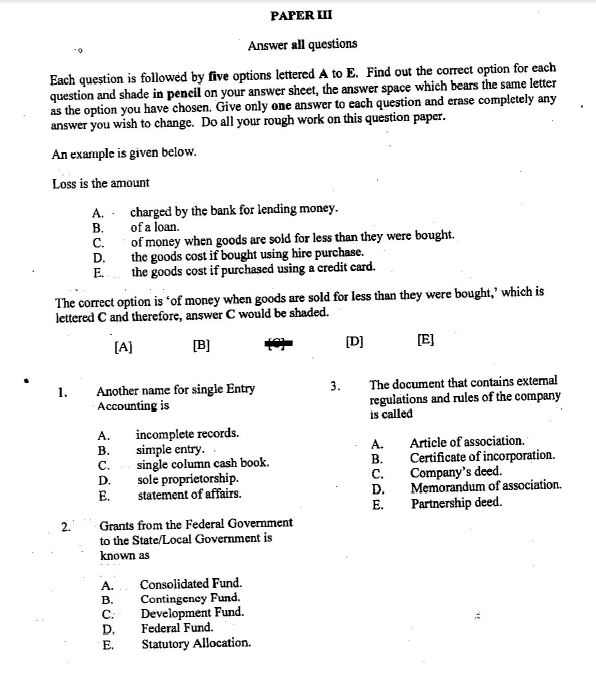

Neco Financial Accounting Objective Questions.

4. Which of the following explains the imprest system of operating petty cash?

A. Weekly expenditure cannot exceed a set amount

B. The exact amount of expenditure is reimbursed at intervals to maintain a fixed float

C. All expenditure out of the petty cash must be properly authorized

D. Regular equal amounts of cash are transferred into petty cash at intervals

E. Expenditure is constant.

5. Which TWO of the following errors would cause the total of the debit column and the total of the credit column

of a trial balance not to agree?

(1) A transposition error was made when entering a sales invoice into the sales day book

(2) A cheque received from a customer was credited to cash and correctly recognized in receivables

(3) A purchase of non-current assets was omitted from the accounting records

(4) Rent received was included in the trial balance as a debit balance

A. 1 and 2

B. 1 and 3

C. 2 and 3

D. 2 and 4

E. 1 and 4.

6. Peter has not kept accurate accounting records during the financial year. He had an opening inventory of N6,700 and purchased goods costing N84,000 during the year. At the year-end, he had N5,400 left in inventory. All sales are

made at a mark up on the cost of 20%.

What is Peter’s gross profit for the year?

A. N13,750

B. N17,060

C. N16,540

D. N20,675

E. N24,000.

7. Shasia Co extracted the trial balance for the year ended 31 December 2017. The total of the debits exceeded the

credits by N300.

Which of the following could explain the imbalance?

A. Sales of N300 were omitted from the sales day book

B. Returns inward of N150 were extracted to the debit column of the trial balance

C. Discounts received of N150 were extracted to the debit column of the trial balance

D. The bank ledger account did not agree with the bank statement by a debit of N300.

8.

Keep following this page and make sure you bookmark this site for reference purposes. If you have any questions, endeavour to use the comment box below…

Can i see practical question on accounting

Pls I need all the answer of accounting

Can I see only theory question on financial account